Fast Bank Transfer Frequently Asked Questions; About. A Bank Transfer is a transfer of funds from one bank account to another locally. Play jackpot city. In most cases, you will need to log in to your online banking and authorise the bank transfer or authorise your bank to initiate the transfer.

Largest casino in louisiana. With PayPal's instant money transfer service, transferring funds to your bank account is fast and simple. Bovada checks 2015. Transfers typically occur in 30 minutes or less. FAST (Fast and Secure Transfer) is an electronic funds transfer service that lets you transfer SGD funds almost instantly from one bank to another within Singapore. With effect from 5 February 2018 - FAST transfers. Fast And Secure Transfers (FAST) allows you to transfer funds instantly between participating banks and non-bank financial institutions (NFIs) in Singapore! Instant fund transfers on-the-go You can transfer and get the funds credited instantly into any of the FAST. Cost of Wire Transfers. Unlike some electronic payments, bank wires cost money—anywhere from $15 to $50 per transfer. The fee depends on the bank, whether the wire is outgoing or incoming or domestic or international, and the transfer.

Bank To Bank Transfers Instantly

| Question | Answer | ||||||||

| 1. What is FAST? | FAST (Fast And Secure Transfers) is an electronic funds transfer service that enables customers of the participating banks to transfer Singapore Dollar funds from one bank to another in Singapore almost instantly. | ||||||||

| 2. Why is there a need for FAST? | FAST was introduced in response to the increasing demand from consumers and businesses for funds transfers that are faster and more efficient. Currently, it can take up to three working days for customers to transfer money from one bank to another. | ||||||||

| 3. When will FAST be launched? | FAST was launched on 17 March 2014. | ||||||||

| 4. Which are the participating banks of FAST? | For the latest list of participating banks, please refer to https://www.abs.org.sg/consumer-banking/fast. | ||||||||

| 5. Why are only certain banks participating in FAST? | The decision to participate in FAST is based on individual banks' commercial considerations. More banks may join at a later date. | ||||||||

| 6. Will eGIRO continue to be made available? | Yes. You can still transfer funds using eGIRO. | ||||||||

| 7. How does FAST compare with other payment modes? | a. FAST enables almost immediate receipt of funds. You will know the status of the transfer by accessing your bank account via UOB's internet banking platform for business.

b. FAST is available anytime, 24x7, 365 days. | ||||||||

| 8. Are transfers via FAST secure? | Yes. FAST is secure and adopts the same security standards established by the banking industry in Singapore for funds transfers. | ||||||||

| 9. What are the operating hours of FAST? | Most participating banks offer FAST 24x7. For further details of operating hours of FAST offered by UOB, please refer to section B. | ||||||||

| 10. Who can use FAST? | Customers with savings or current accounts at the participating banks can use FAST. | ||||||||

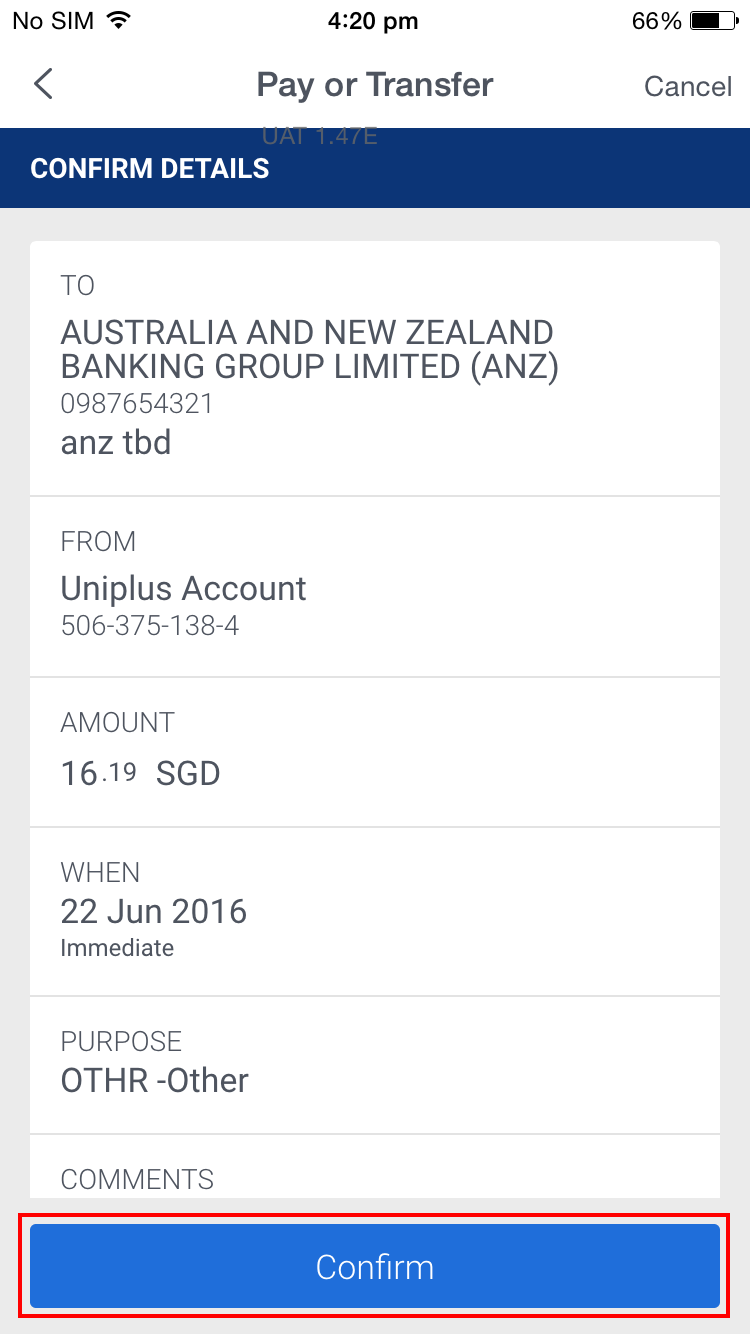

| 11. How do I use FAST to transfer funds? | Businesses can access FAST via UOB's internet banking platform for business customers. You will need the recipient's name and bank account number to transfer funds. | ||||||||

| 12. Can I use FAST if I have the recipient's name only and not the account number? | No. The recipient's bank account number is required to use FAST. The recipient's name is for reference purposes only. | ||||||||

| 13. Can I make a funds transfer from a FAST participating bank to a non-FAST participating bank? | No, FAST only enables funds transfer between accounts of the participating banks in Singapore. Funds between a participating and a non-participating bank can be transferred via eGIRO. | ||||||||

| 14. Can I use FAST to transfer funds to a bank account overseas? | No, FAST can only be used for Singapore Dollar funds transfers between bank customer accounts of the participating banks in Singapore. | ||||||||

| 15. How will I know if my funds transfer via FAST is successful? | You will know the status of the transfer by accessing your bank account via UOB's internet banking platform for business. | ||||||||

| 16. What happens if I made a wrong funds transfer? | Bank customers should exercise due care when keying in the amount and bank account number, similar to using current electronic funds transfer services via ATM or internet banking. Funds transferred via FAST will be credited to the recipient's bank account almost instantly. Please contact our Corporate Call Centre at 1800-226 6121 immediately if you have made a wrong funds transfer. |